In May 2021, SG Alliance Ptd Ltd (“SGA”) received its official license to operate as a financial advisory firm licensed by the Monetary Authority of Singapore.

Central to the firm’s business strategy is the adoption of digital technology including AI, machine learning and advanced CRM automation tools to make client interactions and business operations processing faster, easier and safer than ever before.

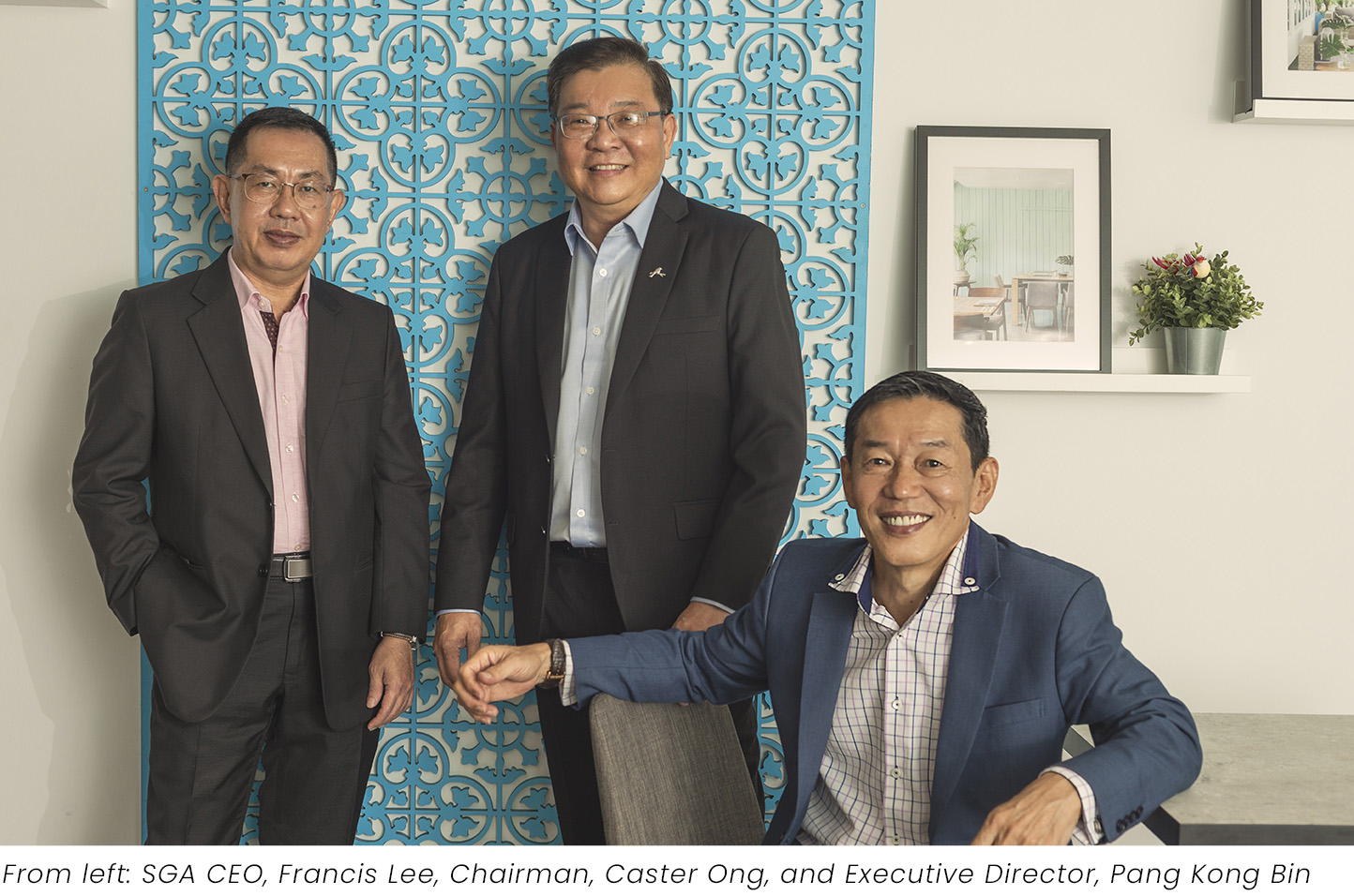

Like every entrepreneur well plugged into the future of economies, SGA founders, Executive Director Pang Kong Bin and Chairman Caster Ong, are firm advocates of investing in the best technology for business. For Pang and Ong, technology is a tool for humans, and being centred on technology-driven efficiency does not have to be at the expense of human interaction or even humans.

Francis Lee, CEO of SGA explains.

“Technology is really coming into play at a very important time. Environmental forces such as global economic shifts and the COVID-19 pandemic have really shored up the needs and expectations of clients in terms of their healthcare protection and wealth planning needs. Financial consultants are increasingly having to find ways to up their productivity to meet this ever-rising complexity of clients’ needs and expectations.”

Pang adds, “That is the main reason why we are putting together the best digital solutions and systems to support our financial consultants (FCs) in their daily work, and to provide our clients convenient access to solutions, information and ultimately a more delightful customer experience.”

Clients of SGA can expect an automated and seamless transactional experience at all touchpoints. The personal financial analysis process is fully digitalised and backed by a smart CRM system. The electronic signature process is another key enabler that provides a trustworthy and secure method for clients and SGA to transact and document acceptance of terms and agreements, making the need to meet face to face no longer necessary when it comes to signing key documents.

Pang believes that while technology can help to speed up gathering, organising and analysing data, and making processes more efficient, it cannot replace the personal touch – the financial consultant.

With insight gained from a combined 70 years of serving clients from all walks and all stages of life, the SGA founders have distilled the essentials of successful client servicing to two things — the power of caring, and the power of choices.

And they are investing accordingly to boost their FCs’ abilities to provide clients with attentive care and bespoke choices.

A Human Force

SGA’s 300-strong team of licensed financial consultants are handpicked based on criteria beyond paper qualifications.

Chosen based on their abilities to always do right by clients to the highest standards of integrity, they are assessed in accordance with SGA’s core values of being people-centred, professional, accountable and enterprising.

The typical SGA consultant is also regularly trained and reminded of the importance of being an active listener, learner and planner, and proactive advisor to clients.

The Tech Factor

SGA’s tech strategy is to make planning more intelligent, intuitive and efficient for FCs, by equipping them with best-in-class data management technology, digital planning tools, proprietary automated processing and CRM systems.

In so doing, FCs can focus more on things that matter, such as smarter solution choices for clients, more client follow-ups and self-improvement activities.

Pang and Ong are already setting up the next milestone for the company. Ong outlines what’s in store.

“As individuals and an institution, we have very wide and strategic networks that we’re not leveraging on systematically. We want to provide the best-in-class client engagement platform where FCs are the centre of information and connections to solve their clients’ problems, beyond money matters.

Because ultimately, the aim of financial resilience is not (just) about having money, but about using it well to keep your best options open at any turn.”